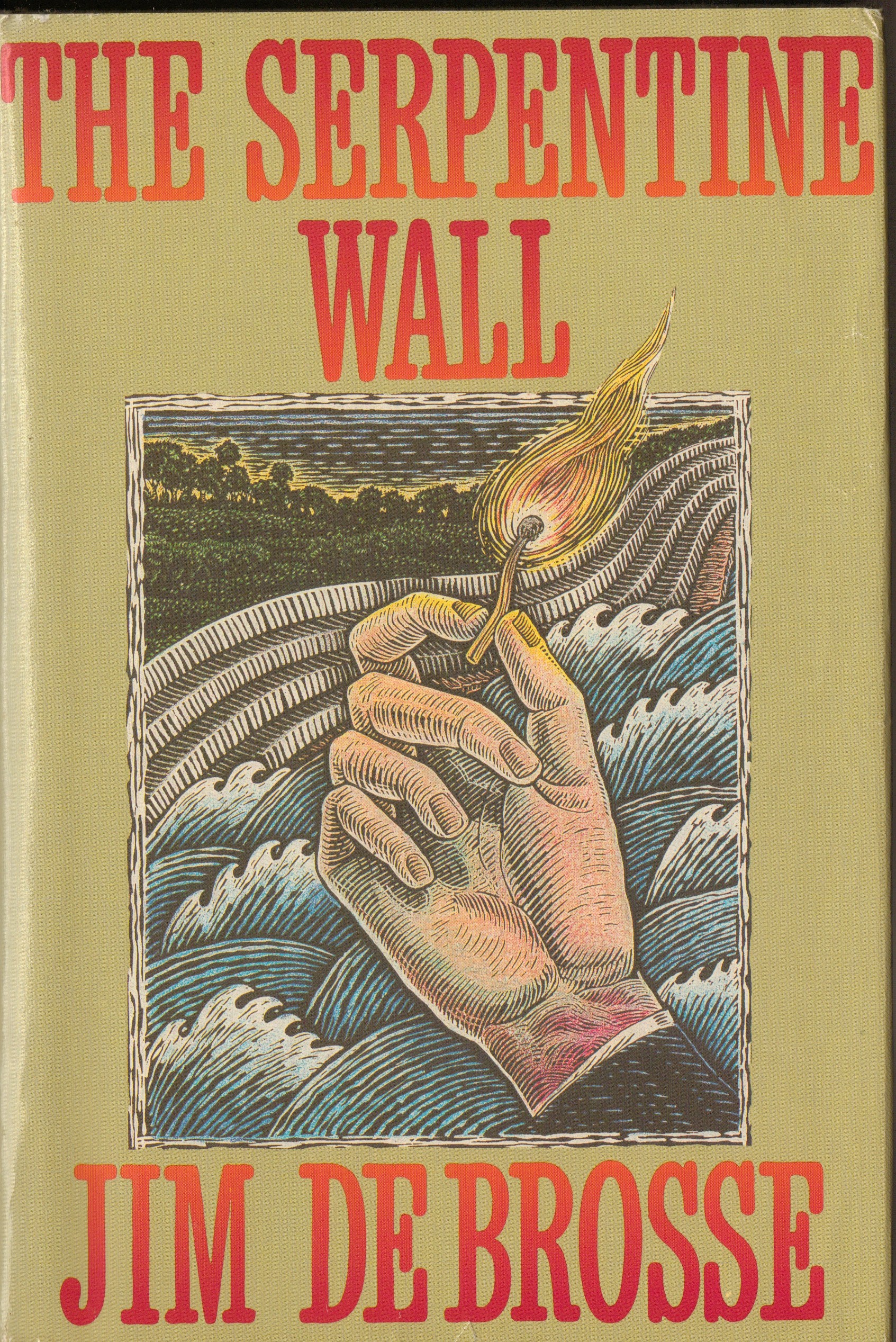

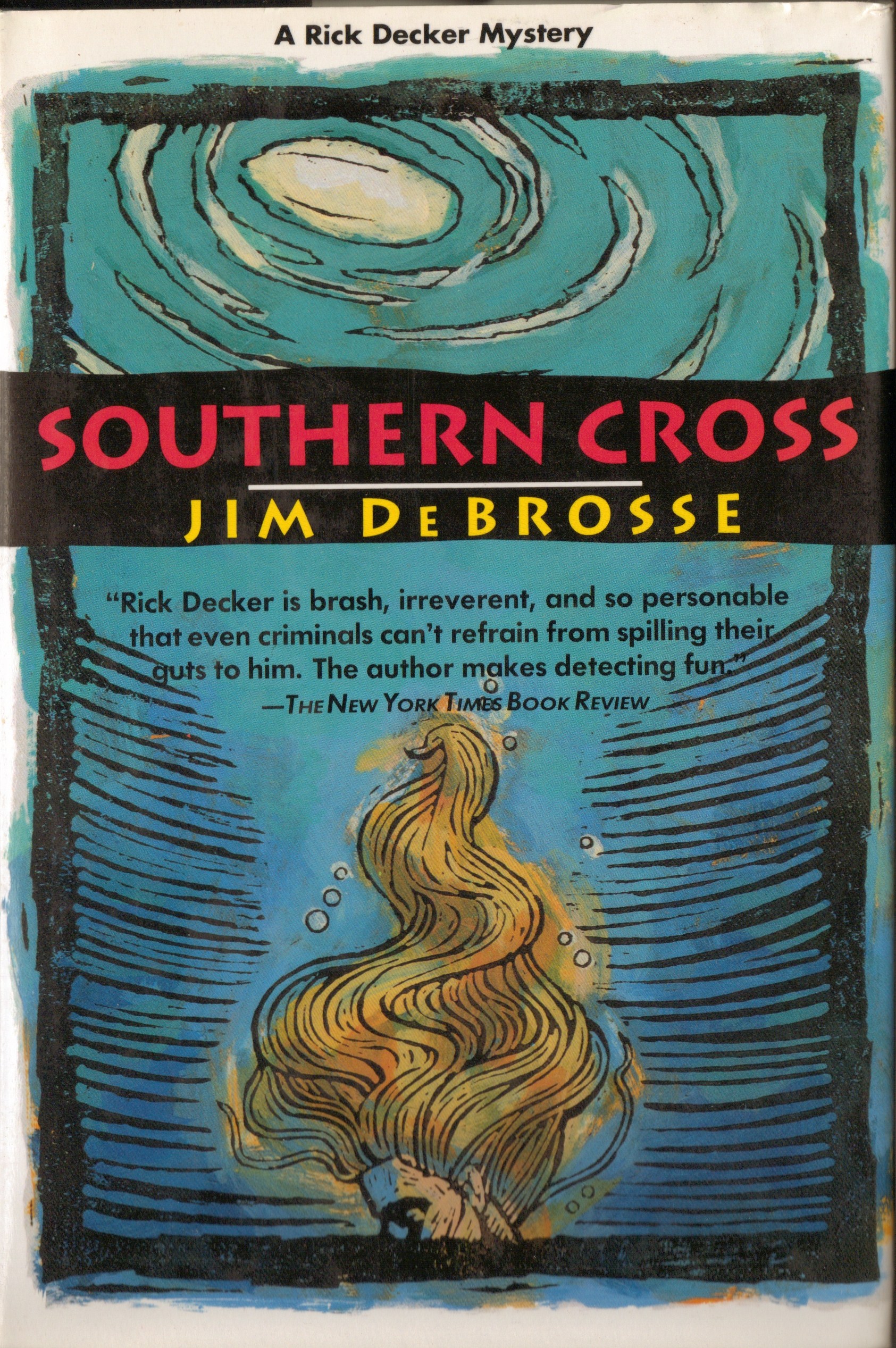

Jim DeBrosse, Ph.D

Author, Journalist, Investigative Reporter, Researcher, Editor, Teacher

I'm the author of five books and an award-winning investigative reporter, magazine writer and columnist currently residing in Indianapolis, Ind. I retired in 2018 as an assistant professor of journalism at Miami University in Oxford, Ohio. I continue to freelance for local and national publications, including The Progressive. Since earning my certification from the International TEFL Academy in 2021, I've volunteered locally and overseas to teach English as a second language.